Most of us look forward to retiring… someday. But as that “someday” gets closer, the fiscal reality of no longer earning a paycheck starts to set in.

When should I start collecting Social Security?

What’s the difference between a 401K and an IRA?

Will we need supplemental medical insurance?

What’s the best way to put money aside for my kid’s college fund?

How much should we have in our accounts in order to maintain our current standard of living?

These are just a few of the questions that come up when workers start to seriously consider retirement. IBEW 1245 has long recognized that planning for a financially sound retirement can be challenging and complex, which is why the union has partnered with Merrill Lynch to offer a series of free retirement planning seminars for our members at PG&E for more than three decades. All members age 45 and over are invited to enjoy a free dinner and listen as experts explain precisely how to plan for retirement, along with critical strategies to ensure fiscal stability when the time comes to stop working.

These are just a few of the questions that come up when workers start to seriously consider retirement. IBEW 1245 has long recognized that planning for a financially sound retirement can be challenging and complex, which is why the union has partnered with Merrill Lynch to offer a series of free retirement planning seminars for our members at PG&E for more than three decades. All members age 45 and over are invited to enjoy a free dinner and listen as experts explain precisely how to plan for retirement, along with critical strategies to ensure fiscal stability when the time comes to stop working.

For the past 32 years, financial guru Bob Gallo has been providing guidance, advice and support for PG&E families to help them understand their retirement needs and succeed in meeting those needs. He knows the ins and outs of every facet, from savings accounts to medical expenses to government benefits and everything in between. In recent years, his son Matt and several other colleagues have joined him, and now every autumn, they hit the road, offering more than a dozen complimentary seminars all across PG&E territory.

“In today’s world, it’s important to understand the risks in the marketplace,” Matt Gallo explained before kicking off the September 14 seminar in Concord. “We’re at a unique stage where all asset classes are at all-time highs, and a lot of things look like they did before the last crash in 2007-2008. And when those sort of economic crashes happen, they tend to affect retirees a lot more than they affect anybody else.”

Matt’s father Bob also underscored the importance of taking advantage of the current markets, while also recognizing how they might change in the future. At the beginning of his presentation, he noted that right now is the absolute best time to secure a fixed-rate mortgage.

“This is the lowest that mortgage rates have ever been in the history of the United States,” he told the attendees. “Is there a chance they’ll get even lower? Not really. Is there a chance that they’ll go back up? More likely, yes.”

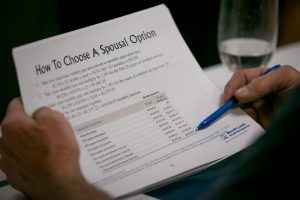

He proceeded to run through his carefully crafted “10 Steps to Prepare for a Successful Retirement,” detailing each component and answering dozens of questions from members as he went along. He also explained, step by step, the best way to utilize the various benefits and sources of income in retirement, including, but not limited to, the PG&E retirement plan.

Most people pay hundreds, perhaps even thousands of dollars to get this kind of in-depth financial planning and advice. But Local 1245 views a secure retirement as a core component of union membership, which is why we offer these seminars for free each year. Additionally, at the end of the seminar, members have the option to sign up for a free one-on-one planning session with the Gallos or one of their associates, where they assess each individual’s situation and run the numbers accordingly so members know exactly how much they’ll need to retire.

Nearly all members who attend these seminars leave the room armed with more information than they had when they first arrived.

Nearly all members who attend these seminars leave the room armed with more information than they had when they first arrived.

“I learned quite a bit actually,” Patricia Abney, who works in Dispatch out of San Ramon, said after the Concord seminar. “I really liked the part where they explained when is the best time to take Social Security. I have a husband who’s already retired but was an employee for PG&E, so it helped for me to understand how the retiree medical [plan] affects us. I also liked seeing the way they do the calculations. Now I know that I’m on track, so I feel good about that.”

There are 10 more seminars scheduled over the next month in Stockton, Monterey, San Luis Obispo, San Mateo, Bakersfield, Fresno, Santa Rosa, Redding, Chico and San Jose. For more information, contact Kindy Mann at 800-234-3858.

Photos by John Storey