General Questions

What are the wage terms?

1/1/2016 = 3.0%

1/1/2017 = 3.25%

1/1/2018 = 3.5%

1/1/2019 = 3.25%

Upon ratification, when does the contract go into effect?

The wage increases will go into effect on 1/1/16. However, the changes to the Voluntary Short Term Disability, Voluntary Paid Family Leave, Sick Leave, Vacation and LTD Plan IV don’t go into effect until 1/1/17.

Where can I find all of the actual language changes in the contract?

The Physical TA is here: //ibew1245.com/wp-content/uploads/2015/07/2015-IBEW-TA_Physical.pdf

The Clerical TA is here: //ibew1245.com/wp-content/uploads/2015/07/2015-IBEW-TA_Clerical.pdf.

Overall this seems like a good agreement, but I am concerned about the changes to sick leave.

We agree that this is a different approach. For many years the idea was to save your sick leave in case you had a major injury or illness. But even then a member with the maximum sick leave amount allowed (1040 hours) would only be covered for 6 months. The fact is the majority of our members do not have significant sick leave saved and more than 80% never achieve vacation or additional sick leave bonuses. Finally, for over 10 years, our members have proposed to be allowed to receive some benefit from unused accumulated sick leave upon retirement. Under this TA, those who retire with sick leave will receive 20% of the sick leave in their RHRA account.

Is there anything in this TA for the retirees?

- The Company and Union have agreed to a reopener on retiree benefits in 2016.

- The 13% over four year wage increases in this TA will provide for significant increases in pensions & pension credits for members who will be retiring in the near future.

Are there any changes to our medical/dental/vision care in this agreement?

No, medical, dental and vision care will stay the same. There will be no increase in the 7.5% of the medical premium or the 0% of the premium our members pay for dental and vision through the entire 4 year term of the agreement.

Is the company still funding the medical spending account with the same amount as before?

As part of the contract that was passed in 2012, the amounts of the HAP credits (either from screenings taken or automatically allotted), along with medical deductibles and the out-of-pocket maximums are all locked in through 2020. In addition, if this agreement passes, the 7.5% of the medical premium that members pay would be locked in through the end of 2019.

Why didn’t we go into the full-blown bargaining process that we’ve done in the past?

The negotiation process that occurred this year has allowed IBEW 1245 to focus on major issues and achieve a contract with four years of stability in an industry that is facing rapid change. Recently, IBEW 1245 has had great success with interim ad hoc negotiations in both in Physical and Clerical, gas and electric. By keeping department-specific negotiations out of general negotiations, we were afforded a better opportunity to have experts in the subject from both the Union and the Company focus more time on specific negotiations than could ever happen during typical general negotiations. Bottom line: Ad Hoc is a better place to deal with problems that affect individual lines of progression, classifications and departments.

Are other utilities besides PG&E proposing or implementing similar changes to their time-off programs?

It’s extremely difficult to compare PG&E to other utilities, as very few have the sort of compartmentalized leave program that PG&E has. Nearly all have a more generalized “paid time off” scenario, where all types of sick leave and vacation are lumped together into one bucket (and it’s not a very big bucket). However, we do know that our closest peer — SoCal Edison in Southern California — recently approved a new contract by overwhelming margins that includes the elimination of retiree medical for new hires and the elimination of the cash balance retirement program for new hires (whereas this tentative agreement with PG&E maintains those benefits). Utility workers across the country have experienced significant takeaways and concessions in recent years, and none have the wage increases that rival the 13% included in the PG&E TA in their current contracts. It’s not an “apples to apples” comparison, since all utility companies offer very different packages, but we are confident that this TA far exceeds the industry standard and if ratified would give members at PG&E one of the strongest contracts and some of the best benefits of any utility in the country.

Sick Leave

What is changing with Sick Leave?

Sick leave is being divided between “incidental sick pay” and “capped sick leave.”

- “Incidental sick pay” is much the same as the yearly 80 hours granted for members now, but the 80 hours will be divided into two 40-hour increments, which become available on January 1 and July 1 of each year (beginning Jan 1, 2017). See below for more detail.

- “Capped sick leave” are all the hours of sick leave you have accumulated and have not used by Jan 1, 2017.

How does “incidental sick pay” work?

- Starting on Jan 1, 2017, full-time employees will be allotted 40 hours into an “incidental sick pay” bank. On July 1, 2017 they will be allotted an additional 40 hours into their “incidental sick pay” bank.

- Members who end the year with less than 40 hours of incidental sick time remaining will receive the difference on Jan 1, so they will start the next year with 40 hours of incidental sick time. On July 1, these members will receive another 40 hours of incidental sick time.

- Members who end the year with 40 or more hours of incidental sick will be brought up to 80 hours on January 1.

- Under the revised formula, members will not be able to have more than 80 hours of incidental sick per calendar year (this does not include previously accumulated “capped sick leave”).

- Beginning Jan 1, 2017, sick leave will be charged in half hour (30 minute) increments.

- Regular status part-timers and intermittent members will be allotted prorated “incidental sick pay” based on ratio of straight time hours worked in a year.

At the end of the year, if I have only used 40 hours of my incidental sick time, what happens to the 40 unused hours that are left?

After 1/1/17, the 40 unused hours would have an additional 40 hours added to them on Jan 1. At that point you would have 80 hours in your incidental sick pay for the year and would get no more for that year. If, however, you had 8 hours left unused (instead of 40), the sick hours would be brought up to 40 hours on Jan 1, and then on July 1, another 40 hours would be added.

What if I need to use more than 80 hours in a calendar year?

At that point you can use hours that are in your “capped sick leave“ bank. These are unused sick leave hours that you accumulated over the years prior to 1/1/17. You may also be apply for Voluntary Short Term Disability (see below) or Voluntary Paid Family Leave (VPFL).

What’s going to happen to my existing sick leave bank? And how can I use it in the future?

- Unused accumulated annual sick leave and additional sick leave hours earned through bonuses before 1/1/2017 will remain in your “capped sick leave” bank.

- All of the sick leave that you have accumulated and is still unused at the end of 2016 will be in this bank and will still be available for you to use.

- Capped sick leave hours are only for use for your own illness or injury.

- The only times you will need to use hours from this capped bank are:

- After you have exhausted your calendar year incidental sick pay hours.

- Before going on voluntary short term disability (VSTD). This is not a change from the current process for going onto the State Disability program (SDI).

- Once you exhaust your capped sick leave, you can take the new, more generous VSTD for any extended illness or injury-related absence.

Do I lose all of my capped sick leave bank when I retire?

No. Unlike today those unused hours will now have value at retirement. Any unused hours that are still in your capped sick leave bank at the date of your retirement will be paid out at a 20% rate into a Retiree Health Reimbursement Account (RHRA), untaxed. The 20% rate will be based on your base rate for the classification you are in the year you retire. This RHRA account works the same way as your current HAP credits work now. That money can be used in retirement towards out-of-pocket costs like copays, or even to help pay for vision and dental services.

I’m eligible for my bonus sick leave hours. Do I still get those?

Members who become eligible for their bonus sick leave hours before 12/31/2016 will still receive them. Those who become eligible in 2017 or beyond will not receive bonus sick time since VSTD/VPFL will be provided instead.

Beginning on 1/1/2017, members who have received bonus sick hours (as per 112.3/112.4 of the Physical contract or 7.3/7.4 of the Clerical contract) will have those hours placed into the capped sick leave bank. The capped sick leave hours can only be used for your own illness or injury. Once sick bonus hours out of your capped sick bank are used they will not be replenished the following year.

I’ve been told my whole career at PG&E that I should save my sick leave. Why is that message changing?

The original intent for allowing accrual of a large sick bank was to allow members to receive full wage replacement during a short term disability event or during the five-month waiting period to qualify for LTD. The new VSTD plan covers members for up to 52 weeks at 70% pay with no taxes taken out (more details below), so it is no longer necessary to accrue and bank lots of sick leave hours. Additionally, individuals on VSTD and/or VPFL will now be allowed to continue 401k deductions, accrue vacation (up to 480 hours in a calendar year) , and receive in-lieu-of hours for missed holidays (up to 480 hours in a calendar year)when they return to work.

Do we still get the bonus vacation for low sick leave usage?

Yes, that system will remain in place. See section 111.3 in the Physical agreement and section 8.3 of the Clerical agreement.

How does this new incidental sick leave agreement apply to 10 and 12 hour schedules?

The incidental sick time as well as the capped sick leave are both calculated using hours not days. For someone on a 9, 10 or 12 hour schedule one would use the number of hours to cover the number of hours of their regular shift they would be absent for.

Is the number of “sick relative” (SR) hours we can use a year still limited to 1/2 of our allotment?

Yes. You will still be able to use 40 of your annual 80 hours of incidental sick pay towards a sick relative (SR) when this new system begins on 1/1/17. Additionally, the new VPFL program will also be available to care for sick relatives (see below for more information on VPFL).

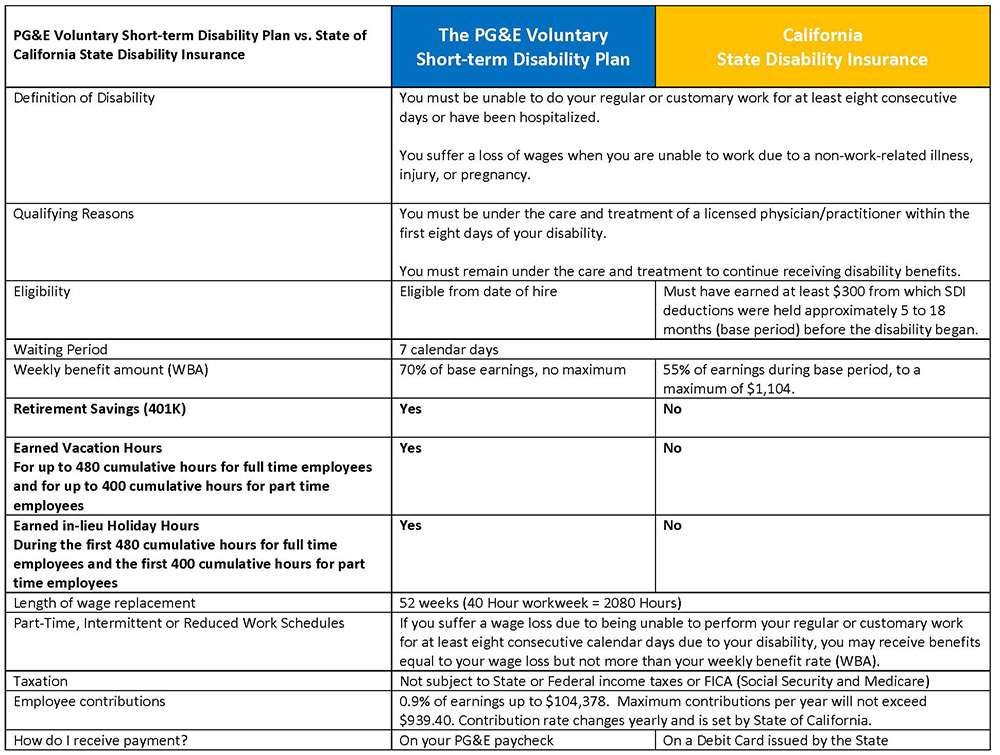

VSTD– Voluntary Short Term Disability

Who does the new VSTD plan help and why have it?

This new program aims to protect all of our members who need to take time off due to their own illness or injury. It is particularly helpful to newer employees who have not had the opportunity to accrue much sick leave yet or others who have had previous illnesses and/or injuries that required them to use much of their banked sick hours. 60% of our members currently have less banked sick leave than is needed to cover the average duration of Short Term Disability (25 days).

What changes are being made to the Short Term Disability plan thru the State of California (SDI); the one we use now?

- It will be moving from a state plan to a private plan that will be administered by PG&E’s third party administrator (Sedgwick).

- The qualification standards for VSTD are the same as for the State of CA SDI.

- Any qualifying member will be eligible for up to 52 weeks of VSTD.

- The wage replacement rate will increase from 55% to 70% of the member’s full-time wage, no federal or state taxes, with the same 7-calendar-day waiting period that is in the state plan. The net effect is nearly a full wage replacement.

- If a member on VSTD would receive a larger benefit using the State Disability Insurance fund (SDI) formula, PG&E will increase the STD rate to match the SDI rate.

What makes me qualified to get VSTD?

Just as with State of California’s SDI, in order to get VSTD:

- You must be unable to do your regular work for 8 consecutive days or have been hospitalized.

- You must be under the care & treatment of a licensed physician/practitioner within the first 8 days of your disability and you must remain under the care & treatment to continue receiving benefits.

When does VSTD go into effect?

Will there still be an option to go on partial disability, the way we are able to now with SDI?

Yes. Members can still have the option to work part-time hours while on VSTD intermittently or consecutively (after serving the seven-day waiting period, which is the same as State SDI). In fact, since PG&E will be paying your VSTD and your hours worked, it will likely be far simpler and smoother than the current process which involves receiving both the State SDI checks and PG&E partial paychecks.

Prior to going on VSTD, must I exhaust all hours from my capped sick leave bank?

Yes. This is also true today under the State of California’s SDI program that members are under now. It is a state requirement that employees are not entitled for SDI/VSTD until they a no longer eligible to receive any other wages (e.g. sick time). The state requires that employers using private short term disability must also abide by that requirement.

How does VSTD work for workers on 10 or 12-hour shifts?

The 7 day waiting period for Voluntary Short Term Disability is based on calendar days. The requirement for the waiting period set by the state of CA, says you have to be disabled or miss work for more than 7 calendar days. “Missing work” can be for partial days. The days must be consecutive and for your own disability. For 10 and 12 hour shift or any shift, the 7 consecutive days may include work days or “off days”. For example, a 12 hour shift worker may be scheduled to work 3 days of the waiting period. That person would use 36 hours of incidental sick leave to cover those days or if they had exhausted all of their incidental sick leave they could use hours from their capped sick bank hours.

How are situations where employees who self-report a substance abuse issue or PTSD handled? Are the employees required to exhaust their sick/vacation banks? Would they qualify for VSTD/VLTD?

Both conditions are treated just like any other request for disability benefits. They must be certified by a qualified physician or practitioner. The same terms on usage of sick banks will apply to these situations (e.g. capped sick leave must be exhausted for the certified and covered period).

Disabilities caused by substance abuse and/or addiction are covered. There are limitations on coverage, as follows:

- Employees will qualify for up to 45 days of benefits if they are a resident or an approved drug-free residential facility.

- An additional 45 days (for a total of 90 days) may be paid if they remain a resident of the facility and the physician/practitioner continues to certify the disability.

What happens if I’ve used up all my capped sick/ incidental sick time before I’ve met the 7-day waiting period for VSTD?

- In the unlikely event that a member used up both their incidental and capped sick leave before they met the 7 calendar day waiting period for VSTD, members may request to use their floating holidays or vacation time during the VSTD waiting period or request to take unpaid time off.

- The Union and Company will also be discussing establishment of a company-wide pool that would allow members to donate sick leave to other members that need it.

What happens if I leave PG&E & go to work somewhere else? Will I still be able to use SDI if I’ve been in the VSTD plan? Will my PG&E earnings history be considered by the state to calculate my SDI benefit?

Yes. If you leave PG&E and take a job elsewhere in California, you would still be eligible to get disability benefits through the state (SDI) if you need it. You would be able to take SDI through your new employer until are 1) you are no longer disabled or 2) 52 weeks of benefits have been paid to you. All earnings in the State of CA (at PG&E or other companies) will be considered by the State. The state plan looks at the last 18 months of earnings, from all sources, to establish the Weekly Benefit Amount.

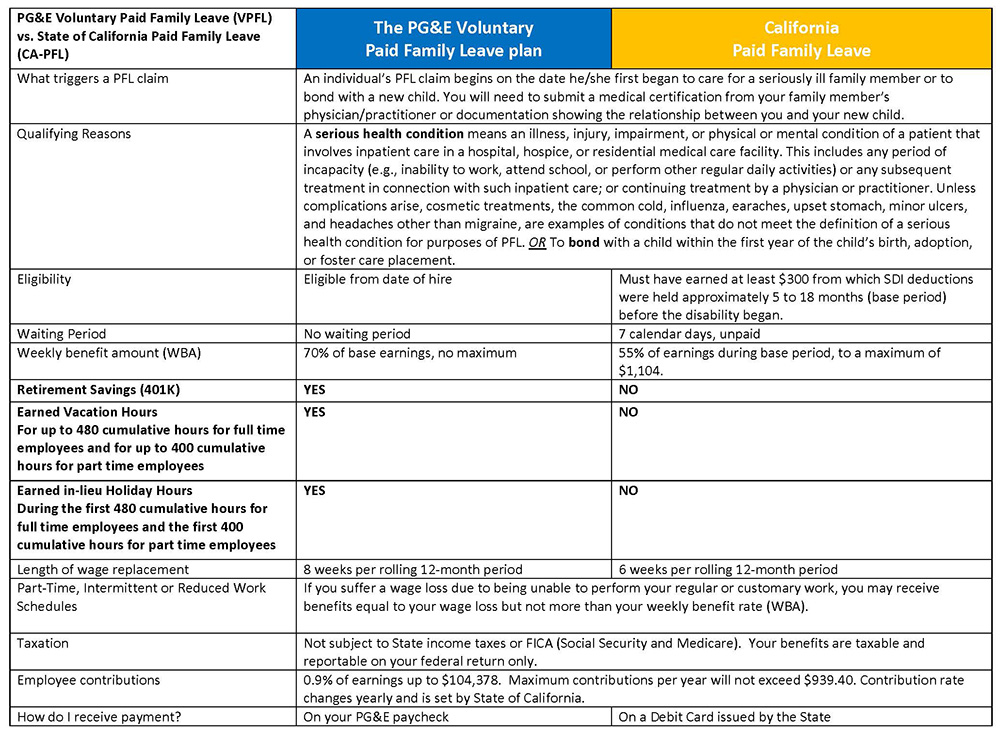

VPFL- Voluntary Paid Family Leave

What changes are being made to Paid Family Leave (PFL)?

- Previously, members were eligible for 6 weeks of Paid Family Leave through the state program. That time period is being increased to 8 weeks or 320 hours through the company’s new voluntary program.

- Wage replacement will be increased from 55% up to 70% of the member’s full-time wage.

- Only federal taxes apply but State of California taxes & FICA taxes do not.

- The 7-day waiting period has been eliminated.

- The cap on the amount paid has been eliminated(currently, state PFL benefits could not exceed $1104/week)

Why change from the existing PFL through the State of CA to the private VPFL?

Bottom line – We feel that the negotiated changes are a strong improvement over the State PFL. This change was negotiated in order give our members an additional 2 weeks of paid time off to care for ill family members or to bond with a new child at a wage replacement rate that is much closer to your full wage than currently is provided through the State of California. In addition, unlike the State of CA PFL there is no 7-day waiting period and no cap on wage amount.

What counts as a qualifying event for VPFL?

- A serious health condition to a family member. A serious health condition means an illness, injury, impairment, or physical or mental condition of a patient that involves inpatient care in a hospital, hospice, or residential medical care facility. This includes any period of incapacity (e.g., inability to work, attend school, or perform other regular daily activities) or any subsequent treatment in connection with such inpatient care; or continuing treatment by a physician or practitioner. Unless complications arise, cosmetic treatments, the common cold, influenza, earaches, upset stomach, minor ulcers, and headaches other than migraine, are examples of conditions that do not meet the definition of a serious health condition for purposes of PFL.

- To bond with a child within the first year of the child’s birth, adoption, or foster care placement.

Who is considered to be a ‘family member’ for VPFL?

The term “family member” as defined under the California Paid Sick Leave Law. It currently includes parent, child, spouse, or registered domestic partner, grandparent, grandchild, sibling, and parent-in-law.

Can I use VPFL intermittently, or does it have to be consecutive?

Members will be able to use VPFL incrementally or consecutively, just the same as they currently can under the state PFL program. Unlike VSTD, there is no waiting period for VPFL.

When does VPFL go into effect?

The program will start on 1/1/17. For Family Leave, eligibility is based on the first date absence for the qualified family member’s need. Anything prior to 1/1/17 is paid from State Plan, and the state will continue to manage until return to work. For Pregnancy Leave, eligibility is based on 4 weeks prior to estimated delivery date and for 6 weeks after delivery for regular delivery or 8 weeks if c-section. So, anything prior to 1/1/17 is paid for by state plan. HOWEVER, if the bonding portion begins on or after 1/1/17 then the employee would be eligible for the PG&E plan for the PFL portion of leave.

LTD – Long Term Disability

What changes are being made to Long Term Disability (LTD)?

For those whose disability begins on or after 1/1/2017;

- They will be considered to be on LTD Plan IV.

- The pay rate for members on LTD Plan IV will increase from 66 2/3% to 70%.

- It includes five years of wage protection for those returning to work.

- Pension credits will not accrue during the time a member is receiving LTD Plan IV benefits.

- No more offset for those on LTD Plan IV with dependents receiving Social Security Benefits.

- They remain eligible to make contributions into the Retirement Savings Plan and receive Company matching contributions.

- The “Stay at work/Return to work” program will allow more opportunities for members on LTD Plan IV to come back to work at PG&E.

- In no case will a member be assigned a classification with a wage rate lower than 70% of the member’s pre-disability rate of pay.

- An IBEW/PG&E oversight committee will be formed to help look into more ways to give opportunities for those on LTD Plan IV a way to get back to work.

- For those returning to work from LTD Plan IV, the sequence of job placement outside of the member’s base classification will follow this progression:

- Line of progression

- Department

- Same bargaining unit (clerical or physical)

- Opposite bargaining unit (physical or clerical)

- Any bargaining unit (ESC,SEIU)

If I am already on LTD, will any of these new changes affect me?

In general, there will be no change to those members who are on LTD Plan I, II or III, however those on LTD plan III will have a voluntary option to participate in a Work Incentive Benefit that is part of LTD plan IV.

That benefit includes:

- For those returning to work from LTD the sequence of job placement outside of the member’s base classification will follow this progression:

- In no case will a member be assigned a classification with a wage rate lower than 70% of the member’s pre-disability rate of pay.

- Wage protection for five years if the member returns to a classification with a lower wage rate.

- Line of progression

- Department

- Same bargaining unit (clerical or physical)

- Opposite bargaining unit (physical or clerical)

- Any bargaining unit (ESC,SEIU)

Vacation

What changed in Vacation?

- Full time members at PG&E with less than 5 years of service will now accrue 15 days of vacation (120 hours) per year. This is an increase of one week.

- Part time members at PG&E with less than 5 years of service will have a commensurate increase in vacation accrual based on the ratio of total straight time hours worked.

- All members will have an option to purchase vacation with pre-tax dollars.

- Vacation will still accrue up to 480 hours while off on VSTD or VPFL.

- Members may not have more vacation hours than one and one-half times their annual accrual rate of their vacation account as of December 31. The company will pay out excess vacation in the same manner as exists under the current agreement (Clerical Title 8/Physical Title 111).

I have 2.5 years with the company, if the proposed contract passes will I be allocated additional vacation hours or does that just apply to new hires?

Yes this applies to you. The additional 40 hours of accrued vacation applies to all members who have less than five years at the company. If the contract is approved by members, you will begin to accrue at this new rate on 1/1/17.

If I want to purchase additional vacation, how does it work?

- You may buy up to 5 extra vacation days per year.

- They must be purchased using pre-tax dollars, and will be paid back in even monthly payments over 12 months.

- You may apply to purchase vacation during the Open Enrollment period which occurs typically in October/November.

- The vacation days you buy will be available for use beginning in January of the year following enrollment. The full allotment that you purchase will be available for use even before they are fully paid for.

- The use of vacation buy (VB) days is subject to supervisory approval and regular guidelines for time off.

- Vacation buy days cannot be deferred and must be used by December 31. If they go unused, they will be automatically paid out in January of the following year at the same rate they were purchased at.

- If you go on an unpaid leave of absence, your vacation buy contributions will be suspended and if you do not return to work in the same calendar year, you will be paid out for any days purchased but not used (or you will be billed for VB days used but not paid for). If you do return to work in the same calendar year, your VB contribution will resume and you will have the balance of your VB day costs deducted over the remaining months of the year.

How does it benefit the entire membership to give new hires (0-4 years) an additional 40 hours of vacation? Doesn’t it water down the benefits of those with more years? Wouldn’t the membership be better served by something that is across the board?

Most components of this package benefit most or all of our members. The wage increases, Voluntary short term disability, and Voluntary Paid Family leave are all examples of across-the-board improvements that benefit nearly all members. Some elements of the agreement do give more “help” to members at different times in their lives. For example, the new sick leave payout at retirement is more beneficial to those members with more seniority and more previously accumulated/capped sick leave, whereas the additional vacation you reference in your question is more beneficial for newer members. Giving people with less than 5 years of service additional vacation will help lots of members and hurts none of our members. Furthermore, if our intention in bargaining this was to get more “yes” votes from newer members, we would have made this benefit go into effect right away, but in fact, it does not go into effect until 2017.