PG&E Retirement Benefits Bargaining

IBEW LOCAL 1245 COUNTER-PROPOSAL

TO PG&E’S ‘COMPREHENSIVE FINAL OFFER’

IBEW Local 1245 on May 5 responded to Pacific Gas & Electric’s “comprehensive final offer” on retirement medical benefits. The union’s counter proposal would ease the burden of medical costs for retired union members and establish Retirement Medical Savings Accounts (RMSAs) to help fund medical benefits for future retired union members.

“Our proposal would do what we’ve proposed to do all along—give some relief to current retirees while creating a mechanism to help future retirees reduce their medical costs at retirement,” said Business Manager Tom Dalzell. “Unlike the company’s proposal, however, we have found a way to achieve this without placing a substantial new burden on active employees.”

Costs have been a major sticking point in the negotiations. Under PG&E’s final offer, the company proposed about $16.9 million in improvements overall: about $8.9 million in improvements for IBEW retirees, and about $8 million in improvements for non-bargaining unit retirees. To help pay for these improvements, PG&E proposed to double the copayment that bargaining unit employees pay—7.5% instead of the current 3.75% and to plan a number of plan design changes that would result in higher payments for services at the point of service.

The union’s counter proposal starts by removing the non-bargaining unit retirees from the equation because the union is only responsible for bargaining for those it represents. Following this logic, the union’s counter proposal focuses strictly on the $8.9 million that PG&E put on the table for those who are IBEW-represented.

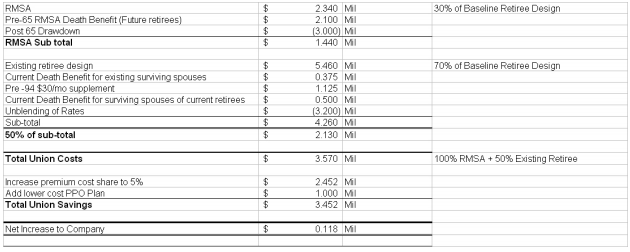

The spread sheet below, put together by the union bargaining committee on May 5, shows how we proposed to distribute the $8.9 million that PG&E put on the table for IBEW represented employees. The Retirement Medical Savings Accounts for current employees (future retirees) make up $1.44 million of the $8.9 million total.

Improved benefits for current retirees make up another $5.46 million of the total. Current death benefits for existing surviving spouses make up $375,000 of the total. A supplement for those who retired prior to 1994 makes up $1.125 million of the total. Current death benefits for surviving spouses of current retirees makes up $500,000. But PG&E achieves $3.2 million savings on a proposed mechanism known as “unblending of rates,” so the union subtracts that figure from the other numbers mentioned in this paragraph, yielding a subtotal of $4.26 million. The union proposes a 50-50 split with the company, meaning PG&E would shoulder $2.13 million. Add to this the entire RMSA cost of $1.44 million, and the cost to PG&E becomes $3.57 million.

The union proposes to offset these costs by adding a lower-cost PPO plan as an option (amounting to a $1 million savings for the company), and increasing the premium cost share to 5% (from the current 3.75%), yielding a $2.452 million savings for the company.

At current rates, this would add $22 a month to the amount paid by the employee with family coverage under the most expensive plan offered by the company.

When these savings are deducted from the company’s union-related costs of $3.57 million (noted above), the net increase to the company is $118,000.

What would union-represented employees and former employees get in return for this hike in the employee co-payment to 5% of the premium? The answer is this: Greater financial security in terms of medical expenses for future retirees. And a measure of financial relief for current retirees, who have borne the full cost premium hikes since the year 2000. Specifically, the company would allocate $5,000 per year to employees after age 45 for their Retirement Medical Savings Account, with an additional $1,000 annual allocation for service over 15 years. Plus the RMSA would provide 4.5% interest credit on the $5,000 allocation, and 4.5% postretirement interest credit on the $1,000 allocation.

There would be limits on how quickly money could be withdrawn from the RMSAs. Before age 65, the drawdown maximum would be 65% of the total in 2011, 63% in 2012, 61% in 2013, 59% in 2014, 57% in 2015, 55% in 2016 and beyond.

The post-65 drawdown would be 33% in all years. There would be no death benefit.

For current retirees, the benefits would be as follows:

For pre-Medicare, PG&E would pay 65% of the NAP/CAP cost. Retirees would pay the cost of the plan in which they enroll in excess of PG&E’s subsidy, and at least 28% of the cost of the plan in which they enroll. There would be no surviving spouse benefit.

While the union’s counter proposal does not claim to solve all medical issues forever, it provides significant relief to current retirees and establishes a mechanism for current employees to establish significant savings to offset the costs of medical care when they reach retirement. And we believe these figures show we can get the job done with a very modest increase of the employee co-pay to 5%.

In the end, of course, it would be up to the members to decide, in a mail-ballot vote, whether this proposal is worthy of ratification. But remember, this is not a tentative agreement. It is the union’s response to the company’s “final comprehensive offer.” Negotiations are expected to resume shortly.

Please keep checking the union website at www.ibew1245.com for further updates.