Local 1245 retirees are sounding the alarm about the cost of health care as the union resumes negotiations with Pacific Gas & Electric over health care benefits for active and retired employees.

Local 1245 met with negotiators from PG&E on Jan. 7 and 26 in sessions largely intended to research the facts that will be relevant to the negotiations. The parties plan to meet again on Feb. 10 and 24, and to begin full-scale bargaining in March.

Retirees are closely watching the progress of these negotiations, and are encouraging PG&E retirees to attend Local 1245 Retiree Club meetings monthly to show support for progress in the negotiations.

At the January meeting of the East Bay Chapter in Dublin, members and spouses discussed their hopes for the negotiations. Several advised current employees to pay close attention to the fate of retirees on this issue because they will face the same problem when they

enter retirement.

A sampling of the Retire Club members’ comments appears here.

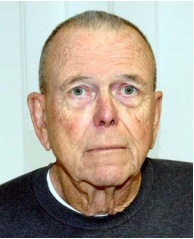

I want to see this medical for retirees come about. I’m raising two grandsons, and I can feel it in my pocketbook.

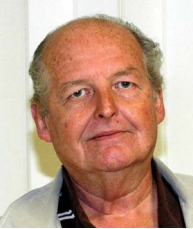

Ronald Meier, initiated into IBEW 1966, retired 1993

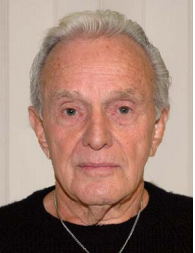

The main thing is to get the cost of medical premiums lowered. Some people are paying $200/month for prescription drugs. The union should try to get what’s good for everybody. PG&E should heed some of the letters they’ve been getting from us, pay attention to what the retirees are saying.

Mel Hambrick, initiated into IBEW 1962, retired 1993

I’d like to see something done about medical—down the line that’s going to increase. With all the other increases in living expenses it’s making it tougher and tougher to manage. I have always been a union member—I believe in the union. Some people think they’re going to get it anyway, but these company’s don’t give it to you out of the goodness of their heart… It’s a shame some retirees don’t want to take time

to come to the retiree meetings and then they want to know, ‘Hey, what’s going on?’ I think that’s a shame.

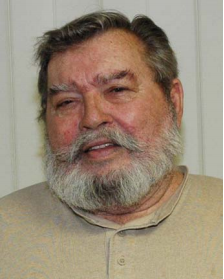

Lawrence Souza, initiated into IBEW 1951, retired 1992

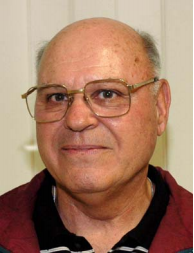

I retired 14 years ago. You figure 3% inflation

(per year), that’s 42% of my buying power gone. The price of commodities has gone up so high it’s even worse. We have had no help for our pension. Fourteen years ago I retired with $2051 a month. After taxes, I was bringing home $1400 a month. But now I’m paying close to $500 a month in medical…We shouldn’t have to pay anything. You have all the CEOs getting these big bonuses. The companies should be proud of their retirees and show it.

Basilio Mendoza, initiated into IBEW 1957, retired 1995

We have the ‘cadillac’ of insurance companies. Basilio had surgery (in the 1990s). The other plans won’t let him keep the two specialists he needs. Those two prevented him from having a permanent disability. I feel, with the high cost of insurance and the everyday cost of living going up, our paycheck is being raped.

Luane Mendoza, spouse

I’m fairly new. I haven’t been retired that long. I think some of the guys who retired years ago need a raise. I know a guy who retired in 1989 he really needs a raise. I don’t know how he makes ends meet.

Doug Paulo, initiated into IBEW 1965, retired 2008

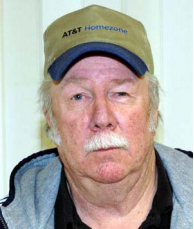

It’s getting out of hand. My friends in the ‘old farts’ club say their main concern is the health care. I’m very fortunate I have a wife still working. I wish PG&E’d just say ‘We’re going to pay the retiree medical plan,’ or extend the RPOA. When the company did that 50% RPOA, that was great.

“Dirty Joe” Inderkum, initiated into IBEW 1976, retired 2001

The RPOA, we just ran through that. We’re looking at $500 a month. I didn’t count on that. And our medicines are going up, too. If you get a raise the taxes eat into that, so relief on the medical is the thing that would help people the most.

Ken Gann, initiated into IBEW 1964, retired 1999, with Becky Gann, spouse

I’m a recent retiree, but I know it’s going to cost me $500 a month. If PG&E could find a way to pay toward the supplemental. I hear stories about people whose pension doesn’t even cover medical. That’s something these young people need to think about. Their time will come. It may cost you a little more (to help retirees now), but it will cost you $500 a month when you get there yourself. That will start hurting after a while.

Jerry Waylett, initiated into IBEW 1982, retired 2007

I’d like to see a continuation of the RPOA. Don’t put a limit on it, but say, ‘We’ll pay 50% of the premium for the term of the contract so you don’t have people running out of money (in their RPOA account) like you do now. RPOA is the best benefit we can get. I think it was a mistake to separate the benefits from the rest of the contract.

Gary Abrahamson, initiated into IBEW 1964, retired 1998

All of us are in the same boat—the medical continues to go up and we’re paying all our retirement to the medical program. My pay is $260 less than when I retired because of the medical. Those of us who had good jobs and worked hard, we always expected the medical… I know it’s expensive, but the company should take care of retired employees to honor them for the work they put in.

Don Johannsen, initiated into IBEW 1972, retired 2002

My concerns are my health and my wife’s health. Health care is deteriorating my pension income, and the economy is deteriorating my investments to where it’s affecting my standard of living. I’m very concerned that we get a break on the medical.

Mike Silva, initiated into IBEW 1961, retired 1993