Study says California utilities should only pay for wildfires if they are negligent

In a 12-page report analyzing the costs of deadly wildfires in California, the Wharton Risk Management and Decision Process Center at the University of Pennsylvania included among its recommendations that utilities should pay for property damages from wildfires only if it has been determined they acted negligently.

“Utilities must provide power, even in high-risk areas,” the report said. “If they operate their system according to the highest safety standards, but a prolonged drought, a heat wave, and high wind conditions combine to blow debris into a line and it sparks a conflagration, should they be required to pay all property damage associated with that fire?”

Wharton weighed in as the Mendocino Complex Fire was recently pronounced the largest wildfire in state history and lawmakers in the final two-plus weeks of the legislative session in Sacramento wrestle over whether to change a controversial legal doctrine called “inverse condemnation.”

The saying doesn’t exactly roll off the tongue but under inverse condemenation, as interpreted by California courts, utilities can be held liable for damages caused by wildfires linked to their equipment — even if the power companies followed accepted safety procedures.

The utilities say that’s unfair and leaves them vulnerable to massive financial liabilities but supporters of inverse condemnation say it is essential to make sure utilities do their level best to lessen the chances of fire.

As part of their suggestions for policy reform, the four authors of the Wharton Center report said, “The application of inverse condemnation to wildfires ignited by power lines or electric utility equipment is ill-founded.”

Diane Conklin, spokesperson for the Mussey Grade Road Alliance, an environmental group based in Ramona, doesn’t want to see any changes to inverse condemnation.

“The big electrical utilities in California have been busy, along with Wall Street, in continuing the lobbying for this change in liability, which works against fire victims, ratepayers and citizens,” Conklin said in an email. “Wharton is a long way from California and we are surprised that they took notice.”

The authors of the brief said they looked into the California wildfire debate because the Wharton Risk Management and Decision Process Center has researched risk management for floods and hurricanes — and to a lesser extent — wildfires for more than 30 years.

“Just from an exposure perspective, while all the West has burned and is burning, California does seem to be at the heart of things,” said Carolyn Kousky, the center’s Director of the Policy Incubator.

Money and politics

The debate in Sacramento is heating up — and so is the spending by lobbyists.

As reported by CALmatters, Pacific Gas & Electric spent $1.1 million between April and June on wildfire legislation. Investigators have attributed PG&E power lines and equipment for starting 16 of last year’s deadly Wine Country fires and more than 200 lawsuits have been filed against the San Francisco-based utility.

Insurance companies, who oppose wildfire legislation because less liability for utilities could likely mean the insurance industry picking up the difference, have increased their lobbying efforts in Sacramento by 51 percent this session.

Two wildfire bills are in circulation at the Statehouse — Assembly Bill 33 and Senate Bill 901.

Last month, Gov. Jerry Brown inserted himself into the debate. He established a committee of 10 legislators to explore wildfire issues and just before the committee’s first hearing, Brown sent draft legislation that would alter inverse condemnation. Brown proposed a standard that would balance “the public benefit” of electric infrastructure with a determination of whether the utility “acted reasonably” should a fire break out.

“Just as our firefighting techniques and forest management must adapt to this growing threat, so must California’s laws,” Brown said in a letter.

The Wharton paper cited that 4.4 million homes in California are located in what is called the “Wildland-Urban Interface” — areas where homes are built near or among lands prone to wildfires — the largest number of any state.

Only 7 percent of wildfire ignitions in California come from power lines, the paper said, in many cases because of high winds. When those fires start, they tend to be larger than others.

High winds accompanied the 2007 wildfires in San Diego County that destroyed more than 1,300 homes, killed two people, injured 40 firefighters and forced more than 10,000 to seek shelter at Qualcomm Stadium.

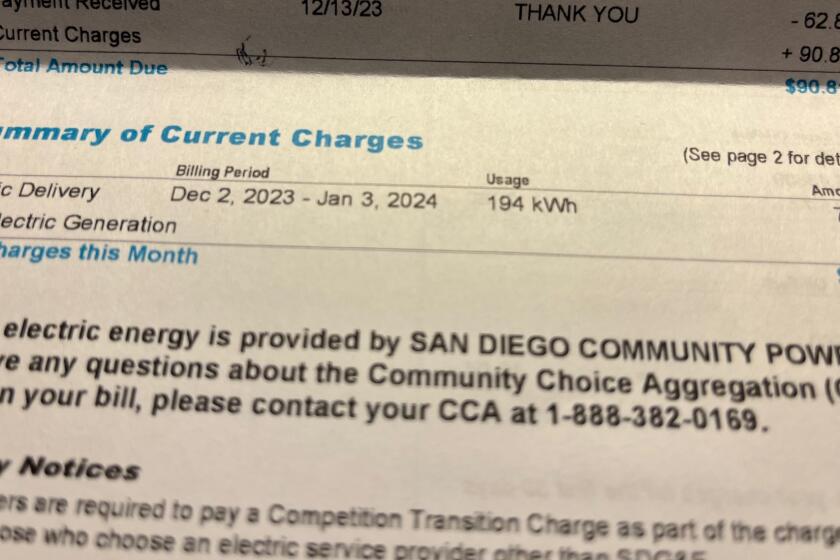

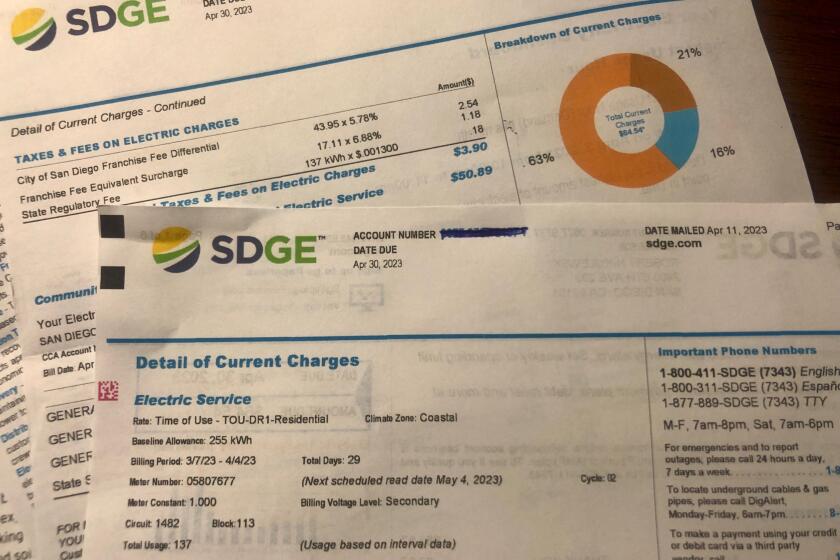

Last November, San Diego Gas & Electric sought to recover $379 million from ratepayers for costs associated to the 2007 fires but the California Public Utilities Commission rejected the request.

“You have a situation where the utility, who is providing what some could say is an essential service in electricity, getting squeezed whether they are negligent or not,” Katherine Greig, a senior fellow and strategic adviser at the Wharton Center said. “We are not advocating for a situation where the utility doesn’t feel pain if it doesn’t take really prudent steps to mitigate starting these fires. We’re just saying be careful what you do in terms of laying all the costs on them.”

Differing views

April Maurath Sommer, executive director and lead counsel for the Protect Our Communities Foundation, an environmental group based in San Diego County, said the threat of strict liability under inverse condemnation ensures utilities don’t scrimp on wildfire prevention measures.

Eliminating the threat of inverse condemnation “insulates shareholders from bad decision making by management,” said Maurath Sommer. “If you act as the utilities would prefer, there’s no consequences to them if they are able to recover all their damages from ratepayers, regardless of how imprudently their management may have acted.”

Kousky of the Wharton Center sees it differently.

“Even if you reform inverse condemnation, utilities cannot pass those costs onto ratepayers unless they get a finding that they’ve acted prudently by the CPUC — that’s not going to go away,” Kousky said. “And being able to pass costs onto ratepayers is critical for them and so there already exists an incentive for them to act prudently through the CPUC process.”

And when the utility is deemed negligent, they are still exposed to lawsuits through the courts.

Maurath Sommer countered by saying the threat of inverse condemnation may have prompted SDG&E to make greater efforts since 2007 to reduce the risk of wildfires. For example, the utility has created a state-of-the art weather center that closely monitors fire risks. SDG&E also employs an Aircrane helitanker that can take to the sky once a fire breaks out and can carry 2,650 gallons of water to douse a fire.

“There’s been an improvement by SDG&E in their safety culture and in their approach to the fires,” Maurath Sommer said. “I think that the system has worked. I’m looking at what has happened in San Diego and there’s not a need to be changing things. PG&E, on the other hand, they apparently haven’t been scared enough.”

J.P. Morgan Chase has estimated PG&E may face more than $17 billion in liabilities from the Wine Country fires and, citing California’s strict liability for wildfire damages, Fitch and Moody’s earlier this year announced credit downgrades for PG&E and Edison International.

The deadly Thomas Fire in December 2017 occurred in the service territory of Southern California Edison.

On Tuesday at the Statehouse, Assembly member Chad Mayes, R-Yucca Valley, called for the creation of a multibillion-dollar insurance fund that utilities could use to cover the “extraordinary costs arising from wildfires.” The money would come from money collected by the power companies.

The legislative session wraps up Aug. 31.

Business

rob.nikolewski@sduniontribune.com

(619) 293-1251 Twitter: @robnikolewski

Get U-T Business in your inbox on Mondays

Get ready for your week with the week’s top business stories from San Diego and California, in your inbox Monday mornings.

You may occasionally receive promotional content from the San Diego Union-Tribune.